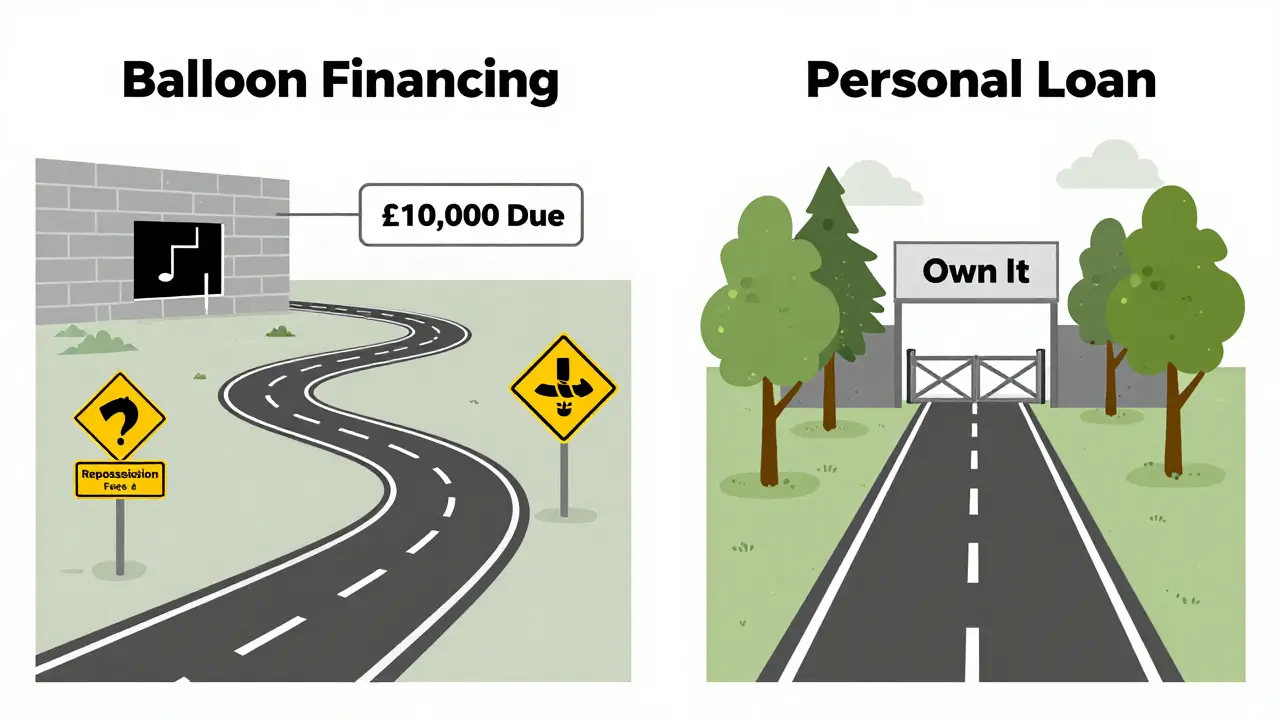

Imagine driving off the lot in a brand-new car with monthly payments that feel almost too good to be true. Then, six years later, you’re hit with a lump sum of £10,000 you weren’t prepared for. That’s the reality of balloon financing for cars - a deal that looks easy at first but can trap you if you don’t know what you’re signing up for.

What Is Balloon Financing?

Balloon financing is a type of car loan where your monthly payments are lower than normal because you’re only paying off part of the car’s cost. The rest - a big chunk called the balloon payment - is due at the end of the term. Most deals last three to five years, and that final payment can be 30% to 50% of the car’s original price.

For example, if you buy a £25,000 car with a 40% balloon payment, you’ll owe £10,000 at the end. Your monthly payments might be just £300 instead of £500 like a standard loan. It’s tempting, especially if your budget is tight right now. But that £10,000 doesn’t disappear. It’s still there, waiting.

This structure is common in personal contract purchase (PCP) deals in the UK. Dealers love it because it keeps monthly costs low, making cars seem more affordable. But the bank or finance company still gets their money - just not until the end.

How Balloon Financing Works Step by Step

Here’s how it plays out in real life:

- You choose a car and agree on the price, term (usually 2-5 years), and the size of the final balloon payment.

- The finance company calculates your monthly payments based on the difference between the car’s price and the balloon amount.

- You make those lower payments each month, along with interest.

- At the end of the term, you have three choices: pay the balloon, return the car, or trade it in.

Most people think they’ll trade in the car. But that only works if the car’s market value is higher than the balloon payment. If it’s not - and it often isn’t - you’re stuck.

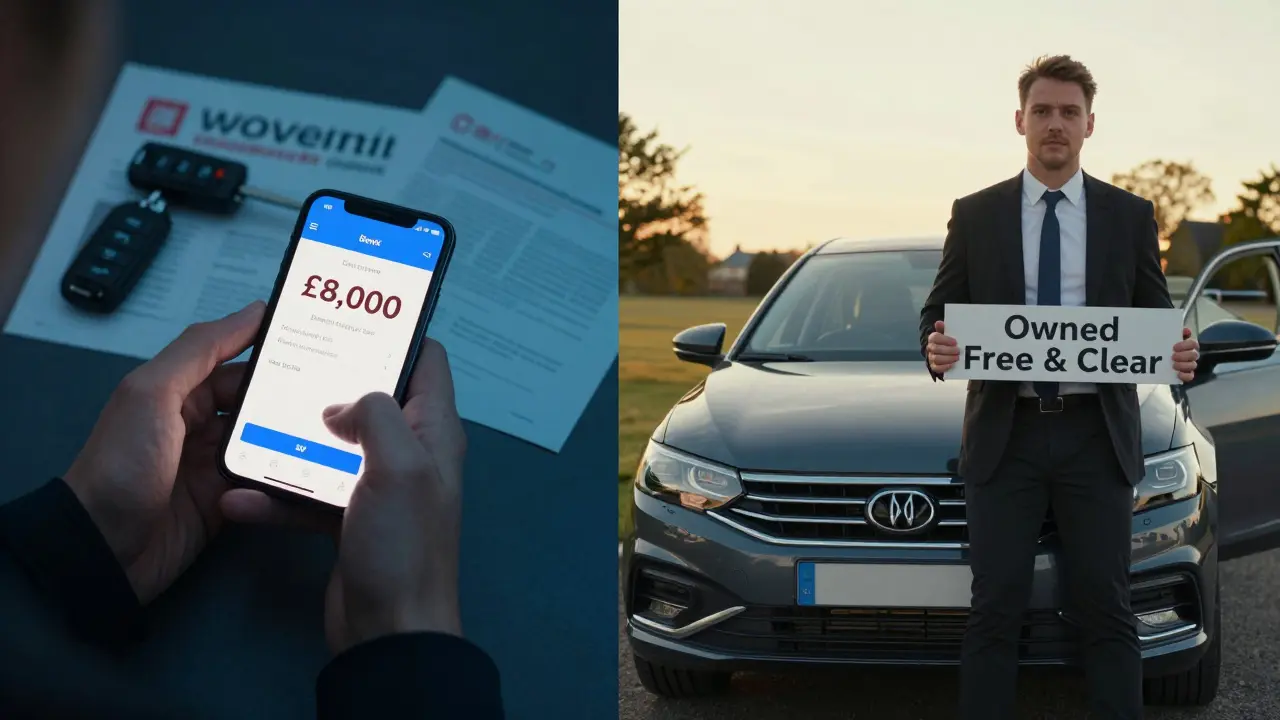

Take Sarah from Bristol. She bought a Ford Focus with a £8,000 balloon payment after three years. Her monthly payments were £240. When the time came, the car was worth only £6,500. She owed £8,000. She couldn’t afford to pay it, and she didn’t want to hand back a car she still liked. She ended up taking out a personal loan just to cover the gap.

Why People Get Trapped

There are three big reasons balloon financing goes wrong:

- Underestimating the final payment - Many think the dealer will just take the car back for free. They don’t realize they’re still on the hook for the difference.

- Car depreciation - New cars lose value fast. A £20,000 car might be worth £10,000 after three years. If your balloon is £12,000, you’re upside down.

- Changing life circumstances - Job loss, illness, or a move can make that final payment impossible. No one plans for that when they’re signing the paperwork.

A 2024 study by the Financial Conduct Authority found that 37% of PCP customers in the UK ended up paying extra at the end - either through new loans or higher interest on rolled-over balances. That’s nearly four in ten people.

The Hidden Costs

Balloon deals aren’t just risky - they’re often more expensive overall.

Because you’re not paying off the full amount during the term, the interest gets added to the whole loan - including the balloon. So you’re paying interest on money you don’t even pay off until the end. That means you could end up paying £5,000 in interest on a £15,000 loan, even though you only paid back £7,000 in monthly chunks.

Also, there are fees. Excess mileage charges, wear-and-tear penalties, and administrative fees can add hundreds more. If you drive more than 10,000 miles a year - common for commuters - you’ll likely pay extra.

And if you miss a payment? The finance company can repossess the car. Even if you’ve paid 80% of the total cost, they still own it until the balloon is cleared.

When Balloon Financing Might Make Sense

It’s not all bad. There are rare cases where it works:

- You plan to trade in the car anyway and are confident the trade-in value will cover the balloon.

- You’re a business owner and can claim tax benefits on the monthly payments.

- You have a lump sum saved up and know exactly when you’ll use it to pay the final amount.

Even then, you need a plan B. What if the car’s value drops more than expected? What if you lose your job? Always ask: “Can I afford this payment if everything goes wrong?”

Alternatives to Balloon Financing

There are better ways to finance a car - without the surprise at the end.

1. Personal Loan

Get a fixed-rate personal loan from a bank or credit union. You own the car from day one. Payments are higher, but predictable. No final lump sum. No risk of repossession if you can’t pay at the end. Interest rates are often lower than PCP deals, especially if you have good credit.

For example, a £20,000 loan at 5% over five years means £377 per month - £137 more than a balloon deal - but you own the car outright when it ends.

2. Hire Purchase (HP)

HP is like a personal loan but tied to the car. You pay monthly, and once you’ve paid the final amount, the car is yours. No balloon. No surprises. It’s straightforward. The downside? Monthly payments are higher than PCP, but you’re building equity every month.

3. Leasing (Personal Contract Hire)

If you just want a new car every few years without ownership, leasing is cleaner than balloon financing. You pay a fixed monthly fee, return the car at the end, and walk away. No final payment. No resale risk. But you’re always renting - never owning.

4. Buy Used

A three-year-old car can save you 30-40% compared to new. Depreciation hits hardest in the first two years. Buy used, pay cash or use a simple loan, and you avoid the balloon trap entirely.

Many certified pre-owned cars come with warranties and low mileage. You get reliability without the financial gamble.

What to Ask Before Signing

If you’re being pushed into a balloon deal, ask these questions:

- What’s the exact balloon payment amount?

- What’s the estimated value of the car at the end? (Ask for a written guarantee.)

- What happens if the car is worth less than the balloon?

- What are the mileage limits and wear-and-tear fees?

- Can I pay off the loan early without penalties?

If they can’t answer clearly, walk away.

Real Stories, Real Consequences

Mark, a teacher in Bath, took a PCP deal on a Volkswagen Golf. Monthly payments were £220. He thought he’d trade it in after three years. But the car’s value dropped to £7,000 while his balloon was £9,500. He couldn’t afford the gap. He rolled it into a new PCP deal - extending his debt by another three years. Now he’s paying £280 a month on a car he doesn’t even fully own.

Meanwhile, Lisa from Bristol bought a used BMW with a £6,000 personal loan. She paid £180 a month for four years. At the end, she owned the car. She sold it for £5,000 and used the money to buy her next car - no debt, no stress.

Final Advice

Balloon financing isn’t evil. It’s just misunderstood. It’s a tool - and like any tool, it can cut you if you don’t know how to use it.

If you want lower payments and you’re certain you’ll trade the car, go ahead. But only if you’ve done the math and have a backup plan. If you want to own your car, build equity, and avoid surprises, skip the balloon. Go for a personal loan or hire purchase.

Don’t let low monthly payments blind you to the real cost. The car isn’t free just because your monthly bill is small. Someone’s still paying for it - and it’s often you, in the end.

Is balloon financing the same as a PCP?

Yes, in the UK, balloon financing is typically offered as a Personal Contract Purchase (PCP). The balloon payment is the final lump sum you must pay to own the car. PCP is just the name dealers use for this type of loan.

Can I pay off a balloon loan early?

Yes, but check your contract. Some lenders charge early repayment fees. Others allow you to settle the loan by paying the remaining balance plus the balloon amount. Paying early can save you interest - but only if you can afford the lump sum.

What happens if I can’t afford the balloon payment?

You can return the car - but only if it’s in good condition and under the mileage limit. If it’s worth less than the balloon, you’ll still owe the difference. Many people end up taking out another loan to cover it, which just pushes the problem forward.

Is balloon financing a good idea for first-time car buyers?

Generally, no. First-time buyers often underestimate depreciation and overestimate their future finances. The risk of being stuck with a large final payment is high. A simple personal loan or buying used is a safer start.

Does balloon financing affect my credit score?

Yes - but only if you miss payments or default. Making payments on time helps your score. But if you can’t pay the balloon and end up in arrears, it can damage your credit. Also, rolling the balloon into a new loan creates more debt, which can hurt your credit utilization ratio.

Comments

King Medoo

I can't believe people still fall for this. Balloon financing is just a fancy way of saying 'I'll let you drive the car while I slowly bleed you dry.' You think you're saving money on monthly payments, but you're just delaying the pain. And when that balloon hits? Good luck. I've seen friends get crushed by this. One guy ended up with a 12% interest personal loan just to cover the gap. At least with a regular loan, you own the car. With this? You're renting with extra steps. 🤦♂️💸

February 4, 2026 at 11:46

Rae Blackburn

This is why the banks own everything now they want you to think you're getting a deal but you're just signing your soul away theyll take your car even if you paid 80 of it because the contract says so and you cant fight it because the lawyers are all on their side you think you own it but you dont youre just a temporary keeper until they decide to take it back

February 6, 2026 at 02:53

LeVar Trotter

There's a fundamental misunderstanding here that needs clarification: balloon financing isn't inherently predatory - it's a structured financial product with specific use cases. The real issue is lack of transparency and consumer education. In finance, we call this 'information asymmetry.' Dealers aren't required to disclose the projected residual value, which is the core metric you need to evaluate whether this is viable. If you're a business owner using this for tax deductions, it's smart. If you're a young professional with no emergency fund, it's a ticking time bomb. The key is modeling worst-case scenarios before signing. Always ask: 'What's my exit strategy if the car depreciates 10% more than projected?' Most people don't even know what residual value means. That's the problem.

February 7, 2026 at 02:58

Tyler Durden

I had a PCP deal on a Honda Civic back in '21. Monthly payments were like $210. Felt like a win. Then the end came. Car was worth $9k. Balloon was $11k. I panicked. Called the dealer. They said 'just trade it in.' But the trade-in offer was $8k. So I had to pay $3k out of pocket. I didn't have it. Ended up taking a 7% loan from my credit union just to cover it. Total interest paid? Over $700 extra. The system is rigged. Why do they make the monthly payments look so cheap? So you don't notice the real cost. I'm done with this. Next car? Cash. Or a personal loan. No more tricks.

February 8, 2026 at 14:09

Aafreen Khan

fr tho why do people even do this like its not that hard to save up for a used car i got my corolla for 8k cash and its 10 years old but runs perfect u think u r saving money but u r just paying more in the long run and dont even get me started on the mileage fees lmao

February 9, 2026 at 02:44

Pamela Watson

I read this whole thing and I'm so mad. My cousin did this and now she's paying $300 a month on a car she doesn't own. She thought she'd just return it. But the dealer said it had 'excessive wear.' She cried. She had a scratch on the rim. That's it. Now she's in debt. You need to warn people. This isn't finance. It's exploitation. They prey on young people. I'm telling everyone I know. Don't do it.

February 10, 2026 at 15:31

michael T

You think this is bad? Try being a mechanic who sees these cars come in after the balloon hits. People show up with tears in their eyes saying 'I just wanted to drive a new car.' I've seen a 22-year-old girl hand over her keys because she couldn't afford $12k. She'd paid $18k already. The car was worth $9k. That's not a loan. That's a trapdoor. And the dealers? They high-five each other. This isn't capitalism. It's psychological warfare. I hate this system.

February 11, 2026 at 17:19

Christina Kooiman

I must point out that the article incorrectly conflates balloon financing with Personal Contract Purchase (PCP). While they are similar, PCP includes a Guaranteed Future Value (GFV) - which is legally binding - whereas balloon financing in the U.S. is often unregulated. Furthermore, the term 'balloon payment' is technically only accurate if the final payment exceeds 50% of the original loan amount. Most PCPs have balloon payments between 30-40%, so this is a misnomer. Also, the phrase 'no risk of repossession if you can’t pay at the end' is dangerously inaccurate. You absolutely can be repossessed - even after 40 payments - if the balloon is unpaid. This article needs a fact-check.

February 13, 2026 at 15:05

Stephanie Serblowski

I love how this article frames it as 'a tool.' It's not a tool. It's a Trojan horse. You get a shiny new car, and then you realize you've been handed a financial grenade with the pin pulled. But hey, at least your Instagram feed looks good for six months, right? 🤡 I work in fintech. We've seen the data. PCP customers are 3x more likely to default in year 4. That's not a coincidence. It's a design flaw. And the worst part? They market it as 'flexibility.' Flexibility? You're flexible like a rubber band that snaps and cuts your fingers. I'm just saying - if you're not rich, don't play. Buy used. Save. Breathe. 🌿

February 15, 2026 at 04:26

Renea Maxima

There's a deeper philosophical layer here that no one talks about. The balloon payment isn't just a financial instrument - it's a metaphor for late-stage capitalism. We're conditioned to consume without ownership. To rent identity. To trade autonomy for aesthetics. The car is not a car. It's a symbol. A performance of success. And the balloon? That's the moment you realize you've been performing for someone else's profit. The system doesn't want you to own anything. It wants you to perpetually lease. The car is just the vehicle. The real debt is existential.

February 15, 2026 at 07:14

Jeremy Chick

I don't care what you say. I got a BMW on PCP. Monthly was $350. I drove it for 3 years. Sold it for $15k. Balloon was $12k. Made $3k profit. I didn't even have to pay anything. Just handed back the keys. Easy. If you're dumb enough to get stuck, that's on you. Stop blaming the system. Learn how it works. Or don't drive new cars. Simple.

February 16, 2026 at 05:26

Sagar Malik

Ah, the classical bourgeois misconception. You presume the market is neutral. But it is not. Balloon financing is a neocolonial financial apparatus designed to extract surplus value from the proletariat under the guise of consumer sovereignty. The residual value is not a mathematical abstraction - it is a weaponized projection of capitalist hegemony. You think depreciation is natural? No. It is engineered. The OEMs collude with finance houses to suppress residual values. This is not finance. It is algorithmic exploitation. And the FCA study? It is a whitewash. The real figures are hidden in offshore SPVs. The truth is buried beneath layers of securitization. You are not a customer. You are a data point in a derivative.

February 16, 2026 at 22:58