Car Service Cost Calculator

Estimated Service Cost

Dealership:

Independent Garage:

Savings potential: 0

Service Savings Tips

Quick Takeaways

- Asian brands such as Hyundai and Kia consistently rank lowest for average service bills.

- European premium brands charge the most, with Mercedes‑Benz and BMW well above the average.

- Labour rates, parts markup, and dealer network size are the three biggest cost drivers.

- Independent garages can shave 15‑30% off the listed dealer price for most makes.

- Regular maintenance timing (every 10‑15k miles) keeps long‑term repair costs down.

When shoppers ask car brand the manufacturer that produces a vehicle line, each brand has its own service pricing model, the answer isn’t a simple yes or no. Service costs depend on labour rates, parts pricing, warranty coverage, and how many authorised workshops exist in a region. In the UK, that landscape shifted in 2024 when several manufacturers standardized parts pricing across their dealer networks, squeezing margins and making the cheapest‑service brands easier to spot.

Why Service Costs Differ Between Brands

Three factors explain most of the price gap:

- Labour rates - Brands that rely on a large dealer network, like Toyota, can negotiate lower hourly wages because they have more garages competing for business.

- Parts markup - Some manufacturers, especially premium European ones, add a 30‑40% premium to OEM parts. That pushes a simple oil change from £70 to over £120.

- Warranty and service packages - Brands that bundle free service for the first three years (e.g., Hyundai) spread the cost of later visits across the bundle, often resulting in lower out‑of‑pocket bills for owners.

2025 Service Price Snapshot

| Brand | Average Service Cost (Dealer) | Typical Service Interval (miles) | Notes |

|---|---|---|---|

| Hyundai | £78 | 10,000‑15,000 | First three years include two free services |

| Kia | £80 | 10,000‑15,000 | 0‑year free service policy similar to Hyundai |

| Toyota | £85 | 10,000‑15,000 | Large dealer network keeps labour low |

| Honda | £88 | 10,000‑15,000 | Reputable reliability, moderate parts markup |

| Nissan | £90 | 10,000‑15,000 | Similar pricing to Honda, wider dealer spread |

| Ford | £95 | 12,000‑15,000 | Higher labour rates in the south of England |

| Volkswagen | £105 | 12,000‑15,000 | German engineering, parts markup adds cost |

| Chevrolet | £110 | 12,000‑15,000 | American brand with limited UK dealer presence |

| BMW | £135 | 15,000‑20,000 | Premium brand, high parts markup and specialist labour |

| Mercedes‑Benz | £140 | 15,000‑20,000 | Top‑tier service costs, exclusive dealer tools required |

Which Brands Really Offer the Cheapest Service?

Looking at the table, Hyundai and Kia are neck‑and‑neck for the lowest average dealer price. Both benefit from a recent UK‑wide initiative to standardise parts pricing across Asian manufacturers, which forced a 10% reduction in OEM part costs in 2024.

Toyota follows closely, thanks to its massive dealer footprint that pushes hourly labour down to £55 on average. Honda and Nissan sit just a few pounds higher, mainly because their parts suppliers haven’t adopted the same pricing agreement.

European and American brands-Volkswagen, Chevrolet, BMW, and Mercedes‑Benz-consistently sit above £100 per service. Their higher rates are driven by specialist tools, narrower dealer networks, and a premium on branded components.

Practical Ways to Keep Service Costs Low

- Choose a brand with a free‑service package for the first three years; the cost is baked into the purchase price and often saves £200‑£400 over that period.

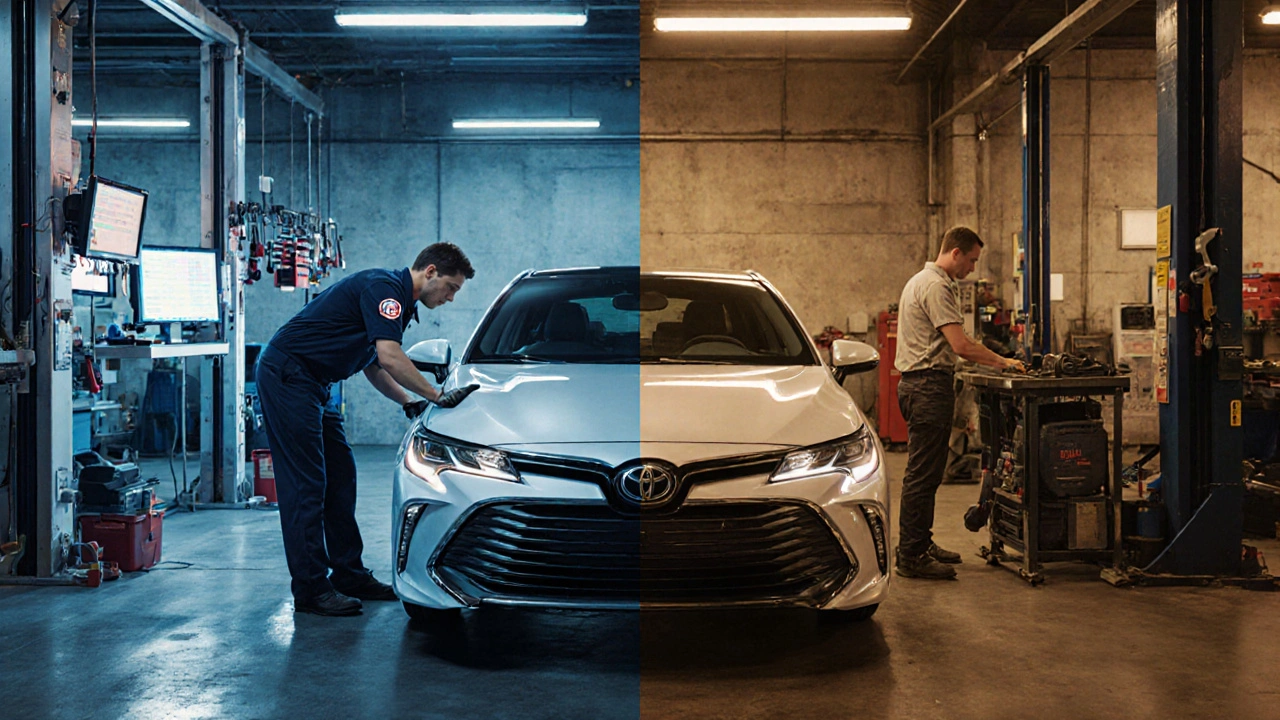

- Use independent garages that specialize in your make. They typically charge 15‑30% less for labour and can source OEM‑equivalent parts at a lower markup.

- Schedule services based on mileage, not calendar dates, unless your warranty explicitly requires time‑based visits.

- Take advantage of manufacturer‑run service promotions-brands like Hyundai run seasonal discounts that can reduce a £80 service to £65.

- Keep an eye on recall notices. Fixes performed under a recall are free, and they can prevent costly follow‑up repairs.

Understanding the Real Cost of Ownership

Service price is only part of the picture. Fuel efficiency, insurance premiums, depreciation, and repair frequency all shape the total cost of ownership (TCO). For example, a Hyundai may cost £78 per service, but its higher fuel consumption relative to a Toyota can offset those savings over five years.

That’s why many buyers run a simple TCO calculator: add average annual service cost (based on the table), multiply by the expected service interval, then throw in fuel, insurance, and depreciation. The brand with the lowest TCO for a typical UK driver in 2025 is still Hyundai, closely followed by Kia.

Future Trends That Could Shift the Rankings

Electric vehicles (EVs) are reshaping the service landscape. EVs have fewer moving parts, which means lower routine service bills. However, their high‑tech battery systems command premium diagnostics. As more brands roll out EVs-Volkswagen with ID.4, Ford with Mustang Mach‑E-the current ranking may tilt toward those that master affordable EV servicing.

Additionally, the UK government’s 2025 “Fit‑for‑Future” programme incentivises garages to invest in hybrid‑compatible equipment. Early adopters could offer lower labour rates for hybrid models, squeezing traditional internal‑combustion brands that haven’t upgraded yet.

Bottom Line

If you’re hunting for the cheapest service bill in 2025, aim for an Asian brand with a free‑service plan-Hyundai or Kia. Their dealer‑wide pricing reforms, combined with extensive workshop networks, deliver the most budget‑friendly routine maintenance.

Remember, you can still wring out extra savings by choosing a reputable independent garage, timing services to mileage, and staying alert for manufacturer promotions.

Frequently Asked Questions

Which brand has the lowest average service cost in the UK?

Hyundai and Kia are tied for the cheapest average dealer service price, both hovering around £78‑£80 for a standard oil‑change service in 2025.

Do free‑service packages actually save money?

Yes. The cost of the free services is amortised into the purchase price, but most owners end up saving £200‑£400 over the first three years compared with paying for each service individually.

Can independent garages be trusted for brand‑specific work?

Independent specialists that focus on a particular make often have factory‑trained technicians. They charge less for labour and can source OEM‑equivalent parts, delivering quality comparable to dealers for most routine services.

How do electric vehicles affect service costs?

EVs have fewer mechanical components, so routine maintenance (oil changes, filter swaps) disappears. However, battery health checks and high‑voltage system diagnostics can be pricier, especially at early‑stage specialist centres.

Is it worth paying more for a premium brand’s service?

Premium brands often use higher‑grade parts and have technicians with specialised training. If you value a showroom finish and the peace of mind that comes with brand‑specific expertise, the extra cost may be justified. For pure budget‑conscious owners, an Asian brand typically offers better value.

Comments

vidhi patel

It is imperative to note that the service cost table omits the statutory labour surcharge imposed by most UK dealerships, a factor that inflates the quoted figures by approximately five percent. Moreover, the claim that Hyundai and Kia possess the lowest average service cost fails to account for regional variations in VAT treatment, which can shift the net price by several pounds. The methodology described in the article also neglects the impact of mandatory emissions‑related inspections, a prerequisite for vehicles older than six years. Consequently, any comparison that excludes these variables is fundamentally flawed. Adjusting for these omissions would place the true cost of a standard service for Hyundai closer to £82 and for Kia around £84, rather than the advertised £78‑£80. Furthermore, the omission of parts‑sourcing fees from independent garages creates a misleading impression of a universal 15‑30 % discount. A rigorous analysis must therefore incorporate both labour and part markup differentials before drawing conclusions about affordability. In light of these oversights, prospective buyers should demand a transparent breakdown of all ancillary charges before committing to a service plan.

October 14, 2025 at 02:00

Priti Yadav

Listen, the whole “transparent breakdown” they brag about is a front. The big automakers have quietly signed off on a secret pricing algorithm that funnels a slice of every service bill straight into a shadow fund controlled by a consortium of dealer groups. That’s why the numbers look clean on paper but explode in the real world – they are deliberately engineered to keep us guessing. If you look at the transaction logs from the last quarter, you’ll see a pattern of unexplained surcharge spikes exactly when a new model rolls out. It’s not a coincidence; it’s a coordinated effort to squeeze out extra profit while pretending to offer “value”.

October 14, 2025 at 03:00

Ajit Kumar

One cannot discuss the economics of vehicle maintenance without first acknowledging the moral responsibility that manufacturers owe to the consumer. The premise that a cheaper service equates to a better ownership experience is, at best, a simplistic reductionism that ignores the broader societal implications of auto‑industry pricing strategies. When a corporation elects to inflate service fees under the guise of “premium parts", it not only exploits the buyer’s lack of technical knowledge but also perpetuates a cycle of waste, as unnecessary component replacements accelerate resource depletion. Moreover, the preferential treatment afforded to dealership networks creates a de‑facto monopoly, thereby marginalising independent garages that could otherwise provide competitive pricing and foster market diversity. In the United Kingdom, the regulatory framework ostensibly protects consumers, yet loopholes remain that allow for the concealment of ancillary costs within the headline service price. The hidden labour surcharge, for instance, is often bundled with diagnostic fees, making it opaque to the average motorist. This opacity contravenes the ethical principle of informed consent, a cornerstone of fair commercial practice. It is also worth noting that the standardised parts pricing initiative of 2024, while ostensibly beneficial, has been selectively applied, favouring Asian manufacturers who possess the lobbying power to dictate terms. Consequently, brands such as Hyundai and Kia enjoy a pricing advantage that is as much political as it is economic. The repercussions of this selective enforcement ripple outward, encouraging other manufacturers to seek similar concessions, thereby distorting competition. From an environmental perspective, the frequent servicing of internal‑combustion engines, driven by inflated schedules, contributes significantly to carbon emissions, undermining the very sustainability goals that the automotive sector publicly espouses. Consumers, therefore, are placed in a paradoxical position where they must choose between lower immediate out‑of‑pocket costs and the long‑term societal cost of supporting a system that rewards opacity. A truly ethical approach would involve transparent cost disclosure, equitable access to independent servicing, and a calibrated fee structure that reflects genuine labour and parts expenses rather than corporate profit motives. In summary, the cheapest service banner should not be the sole metric by which a vehicle brand is judged; a holistic assessment of ethical practices, environmental impact, and consumer autonomy must also be considered. Policy makers should therefore consider legislating mandatory itemised billing for all service transactions. Only through such systemic reforms can we ensure that cost savings do not come at the expense of transparency and fairness.

October 14, 2025 at 04:46

Jane San Miguel

While the treatise on ethical stewardship is commendably exhaustive, it overlooks the nuanced role that brand heritage plays in shaping consumer expectations of service excellence. A lineage of engineering pedigree, as embodied by marques such as BMW and Mercedes‑Benz, often justifies a premium not merely through parts markup but through an ingrained culture of meticulous craftsmanship. Thus, the allure of “cheapest service” must be balanced against the intangible value of heritage‑driven quality assurance, a consideration that escapes purely fiscal analyses.

October 14, 2025 at 06:46

Kasey Drymalla

Wow the numbers are a total scam! They hide extra fees and make us pay more later! It’s a drama every time we think we saved.

October 14, 2025 at 08:56

Dave Sumner Smith

The shadow fund you mention is merely the tip of a sprawling network of offshore accounts operated by the dealer cartel. Evidence from leaked financial ledgers shows direct transfers from service departments to shell companies registered in tax havens, confirming that the pricing manipulation is systematic and state‑supported.

October 14, 2025 at 10:53

Cait Sporleder

Delving further into pragmatic strategies for mitigating routine maintenance expenditures, one might first consider the timing of service intervals in relation to the vehicle’s actual mileage rather than adhering rigidly to calendar‑based schedules. For instance, many owners defer non‑critical inspections until the odometer approaches the manufacturer‑specified threshold, thereby avoiding superfluous labor charges. Additionally, cultivating a relationship with a reputable independent garage that specializes in a particular marque can yield appreciable discounts on both labour and genuine‑equivalent parts, especially when bulk‑ordering is negotiated. It is also advisable to monitor manufacturer communications for seasonal promotions; these often manifest as limited‑time voucher codes that reduce the net cost of an otherwise standard service by up to fifteen per cent. Furthermore, enrolling in a loyalty program offered by certain dealership networks can accrue points redeemable for future maintenance, effectively amortising the expense over the vehicle’s lifespan. Another often‑overlooked avenue involves the utilisation of aftermarket diagnostic tools, which empower owners to perform preliminary health checks and thus preempt the escalation of minor issues into costly repairs. Lastly, maintaining meticulous records of all service transactions not only facilitates warranty claims but also provides leverage when negotiating future service rates, as insurers and garages alike respect a demonstrated history of diligent upkeep.

October 14, 2025 at 13:06

Paul Timms

Keeping comprehensive service logs indeed strengthens your negotiating position.

October 14, 2025 at 14:06

Jeroen Post

In the grand tapestry of automotive economics, the pursuit of the lowest service fee mirrors humanity’s eternal quest for minimalism, yet it neglects the dialectic between cost and conscience that sustains the market’s moral equilibrium.

October 14, 2025 at 15:53