When you hear "full coverage" auto insurance, it sounds like everything’s covered-no worries, no surprises. But here’s the truth: full coverage isn’t a legal term. It’s a marketing phrase used by insurers to describe a bundle of policies that go beyond the minimum required by law. If you’re wondering what’s actually in it and how much you’ll pay, you’re not alone. Let’s break it down without the jargon.

What’s Really in Full Coverage Auto Insurance?

Full coverage isn’t one single policy. It’s three main parts stitched together: liability, comprehensive, and collision. Each serves a different purpose.

Liability coverage is the base. It’s required in every UK state. If you crash into someone else’s car or property, this pays for their repairs and medical bills. It doesn’t cover your own vehicle. Minimum liability limits in the UK are £1.2 million for bodily injury and £1 million for property damage per accident, but most drivers opt for higher limits.

Collision coverage kicks in when you hit something-another car, a tree, a guardrail. It pays to fix or replace your car, no matter who’s at fault. This is where a lot of people get tripped up. If you have an older car worth £2,000 and you’re paying £400 a year for collision, it might not make financial sense.

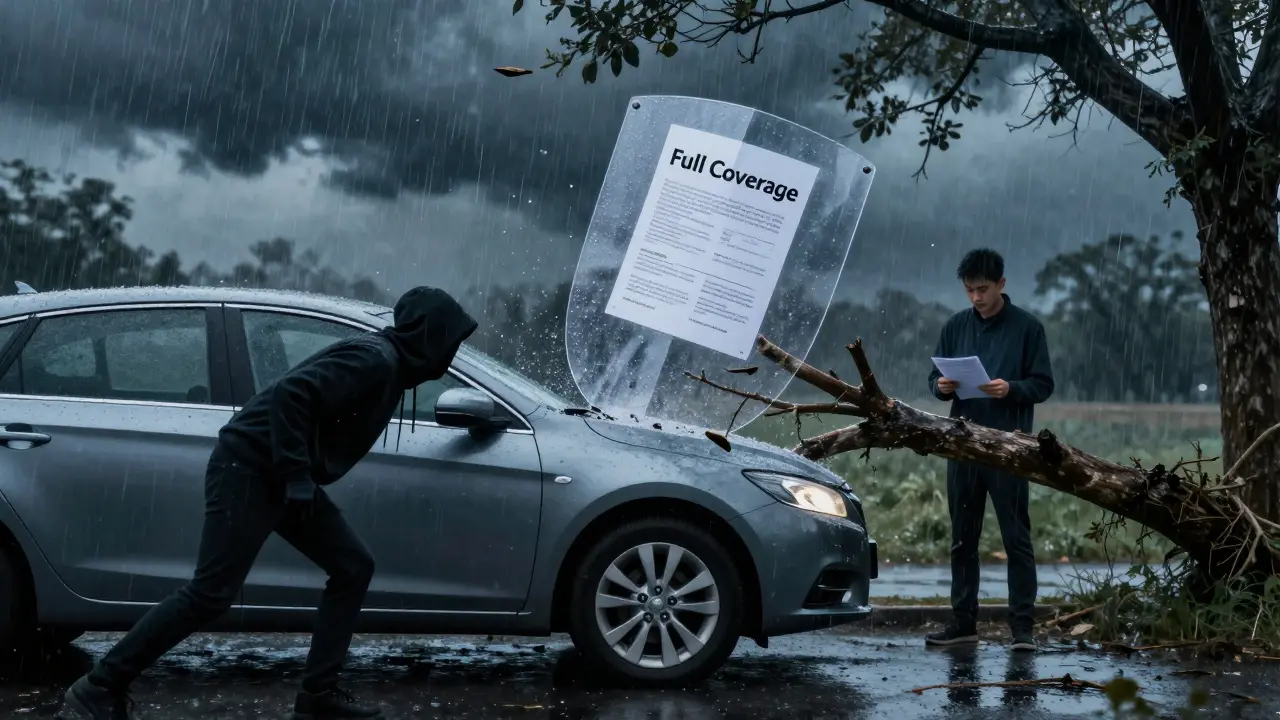

Comprehensive coverage handles everything else: theft, vandalism, fire, storms, falling objects, even hitting an animal. If a tree falls on your car during a windstorm, comprehensive covers it. This is especially important if you live in an area with high crime rates or extreme weather.

Together, these three form what insurers call "full coverage." Some policies also include extras like uninsured motorist coverage, medical payments, or roadside assistance-but those aren’t automatic. You have to ask for them.

How Much Does Full Coverage Cost in 2026?

The average cost of full coverage auto insurance in the UK in 2026 is £980 per year, or about £82 a month. But that number means almost nothing on its own. Your rate depends on five big factors.

- Location-Drivers in London pay nearly twice as much as those in rural Somerset. Urban areas mean higher theft, congestion, and accident rates.

- Vehicle type-A £30,000 electric SUV will cost more to insure than a £8,000 used hatchback. Repair costs, safety ratings, and theft frequency all matter.

- Driving history-One at-fault accident can raise your premium by 40%. A clean record for five years? You’ll get the best rates.

- Age and experience-Drivers under 25 pay 60% more on average. Even at 30, new drivers still face higher premiums than those with decades behind the wheel.

- Credit score-Yes, in the UK, insurers use credit history to set rates. A good score can save you £200+ a year.

For example, a 38-year-old driver in Bristol with a 2021 Toyota Corolla, no claims, and a credit score of 780 might pay £710 a year. The same person with a 2024 Tesla Model Y in Manchester? That jumps to £1,450.

Who Needs Full Coverage?

Not everyone needs all three parts of full coverage. Ask yourself:

- Is your car paid off? If it’s worth less than £2,000, collision coverage might be a waste.

- Do you have savings to replace your car? If you can afford to buy a new one out of pocket, you might skip comprehensive.

- Are you leasing or financing? Lenders require full coverage. No exceptions.

- Do you drive daily in a high-risk area? If you park on the street in a city with rising car thefts, comprehensive is a must.

Most experts say: if your car is newer than 2018 and you can’t easily afford to replace it, keep full coverage. If it’s older and you’re comfortable with the risk, dropping collision and comprehensive could save you hundreds.

Common Misconceptions

Many people think "full coverage" means:

- It covers your medical bills after an accident-wrong. That’s medical payments coverage, which you need to add separately.

- It covers rental cars-nope. Rental reimbursement is an optional add-on.

- It covers damage from natural disasters if you live in a flood zone-yes, comprehensive covers this, but only if you have it.

- It covers personal items stolen from your car-nope. That’s covered by home insurance, not auto.

Also, some assume that because they’re on a low-income plan, they don’t need full coverage. But if you’re involved in a serious accident and your liability limits are too low, you could lose your home, savings, or future wages. Liability coverage is cheap. Don’t skimp.

How to Lower Your Premium

You can cut your full coverage cost without sacrificing protection:

- Bundle with home insurance-Most UK insurers offer 10-20% off if you buy auto and home from the same company.

- Pay annually-Paying in one lump sum saves you 5-8% compared to monthly payments.

- Take a defensive driving course-Some insurers give up to 15% off for completing an approved course.

- Increase your deductible-Raising your collision deductible from £500 to £1,000 can cut your premium by 15-30%. Just make sure you can afford to pay that amount if you need to file a claim.

- Use telematics-If you’re a safe driver, programs like Admiral’s "Mileage Tracker" or LV=’s "My Drive" can cut your bill by up to 40% based on real driving data.

One real example: A driver in Bristol switched from a £1,100 annual policy to one with a £1,000 deductible and telematics. She drove under 8,000 miles a year and saved £420 in the first year.

What Happens If You Drop Full Coverage?

If you own your car outright and decide to drop collision and comprehensive, you’re only protected by liability. That means:

- If you hit a pole? You pay for repairs.

- If your car is stolen? You’re out the value.

- If hail destroys your windshield? You cover the cost.

Some people do this to save money. But if you’re not prepared to replace your car on the spot, you’re gambling. In 2025, the average cost to replace a mid-sized car in the UK was £14,300. Most people don’t have that kind of cash sitting around.

Should You Shop Around Every Year?

Yes. Insurance rates change constantly. A policy that was cheap last year might now be overpriced. Insurers adjust rates based on claims trends, repair costs, and even weather patterns.

Use comparison sites like Confused.com, Comparethemarket.com, or GoCompare. But don’t just pick the cheapest quote. Check:

- Customer service ratings

- Claims handling speed

- Whether they offer roadside assistance

- If they have local agents

A £50 difference in price isn’t worth it if your insurer takes six months to pay a claim after a flood.

| Vehicle Type | Average Annual Cost | Key Factors |

|---|---|---|

| Used Hatchback (£8,000) | £720 | Low repair cost, low theft rate |

| Mid-Range Sedan (£20,000) | £980 | Common model, moderate repair cost |

| Electric SUV (£40,000) | £1,550 | High repair cost, expensive parts |

| Classic Car (1980s) | £410 | Limited use, agreed value policy |

| Performance Sports Car (£50,000+) | £2,300+ | High risk, high theft, expensive repairs |

Final Thoughts

Full coverage auto insurance isn’t a luxury-it’s a safety net. But it’s not one-size-fits-all. The goal isn’t to buy the most expensive policy. It’s to buy the right one for your car, your budget, and your risk tolerance.

If you drive daily, live in a city, and can’t afford to replace your car tomorrow, keep it. If your car is old, you drive rarely, and you’ve got savings, you might save money by dropping collision and comprehensive. Just don’t drop liability. That’s your legal shield.

Review your policy every year. Ask questions. Compare. And remember: the cheapest quote isn’t always the best deal. The best deal is the one that actually works when you need it.

Is full coverage auto insurance required by law in the UK?

No, only liability coverage is legally required in the UK. Full coverage-which includes collision and comprehensive-is optional. But if you’re financing or leasing a car, your lender will require it.

Can I get full coverage on an older car?

Yes, you can. But it may not be worth it. If your car is worth less than £2,000 and you’re paying over £500 a year for collision and comprehensive coverage, you’re likely spending more on insurance than the car is worth. Consider dropping those coverages and keeping only liability.

Does full coverage cover rental cars?

Not automatically. Full coverage typically extends to rental cars for the same types of damage (collision, theft, etc.), but only if you have those coverages on your policy. Some insurers require you to add rental reimbursement separately to cover the cost of a rental while your car is being repaired.

What’s the difference between comprehensive and collision?

Collision covers damage from accidents involving another vehicle or object-like hitting a tree or another car. Comprehensive covers non-collision events: theft, vandalism, fire, hail, falling objects, or hitting an animal. They’re two separate parts of full coverage.

How can I reduce my full coverage premium?

Raise your deductible, bundle with home insurance, pay annually, take a defensive driving course, or use a telematics device that tracks your driving habits. Safe drivers can save up to 40% with usage-based programs.

Is full coverage worth it for electric cars?

Yes, usually. Electric cars cost more to repair-especially batteries and sensors. A single damaged camera or charging port can cost £1,500+. Full coverage helps protect that investment. Many insurers now offer special EV policies with lower rates for home charging and battery coverage.

What happens if I don’t have full coverage and I total my car?

If you only have liability and you total your car, you get nothing from your insurer. You’ll need to pay out of pocket to replace it. If someone else hit you and was at fault, their insurance should cover your car-but if they’re uninsured, you’re stuck.

Comments

Rubina Jadhav

Just wanted to say this post really helped me understand what full coverage actually means. I was confused for years thinking it covered everything. Now I know I can drop collision on my 2015 Honda since it's only worth £1,800. Saved £300/year already. Thanks!

February 14, 2026 at 16:54

sumraa hussain

OMG I JUST REALIZED I’VE BEEN PAYING FOR FULL COVERAGE ON MY 2012 SKODA FOR 5 YEARS AND IT’S WORTH LESS THAN MY MONTHLY PREMIUM???!!?!?!?!? I’M CRYING AND LAUGHING AT THE SAME TIME. THIS IS THE WORST AND BEST THING I’VE LEARNED THIS YEAR. THANK YOU. I’M DROPPING EVERYTHING BUT LIABILITY. I’M FREE. I’M A FREE MAN. I’M A FREE MAN WITH A 14-YEAR-OLD CAR. LET’S GOOOOOO.

February 15, 2026 at 21:54

Raji viji

Let’s be real - most people who say they need full coverage are just scared of their own shadow. You think a £400/year collision policy is gonna save you when your ‘investment’ is a £2,500 Corolla? That’s like buying a diamond-encrusted helmet for a bicycle. You’re not protecting your car, you’re protecting your ego. And don’t even get me started on telematics - insurers are just tracking your every move to jack up your rates later. It’s surveillance with a discount. Smart? No. Desperate? Yes.

February 16, 2026 at 17:59

Rajashree Iyer

There’s a beautiful paradox here - we spend our lives accumulating things, only to spend more money protecting them from the very world we live in. Full coverage isn’t about safety. It’s about control. The illusion that if we just pay enough, the universe won’t take. But the storm doesn’t care about your deductible. The thief doesn’t check your credit score. And your car? It’s just metal and plastic. Maybe the real insurance is learning to let go. To accept that loss is part of the ride. Not the car. Not the policy. But the journey.

February 18, 2026 at 00:38

Parth Haz

Thank you for this clear, well-structured breakdown. I’ve been advising clients on insurance for over 12 years, and this is one of the most accurate summaries I’ve seen. Especially the point about liability limits - too many people think minimum coverage is enough. It’s not. One lawsuit, and you’re looking at bankruptcy. Also, bundling home and auto is still the single best way to save. I always recommend it. Keep up the great work.

February 19, 2026 at 07:50

Vishal Bharadwaj

Wait wait wait - you said the average is £980? That’s fake. I just got a quote for £1,400 on my 2020 Hyundai and I’m in BIRMINGHAM not LONDON. Also, you totally ignored that insurers now use AI to predict risk based on your social media. I posted a pic of my bike last month and my premium jumped 22%. And credit score? I’ve got 750 and still got hit with £1,200. So your ‘average’ is just marketing fluff. Also, you missed that some insurers now charge more if you live near a petrol station. Yeah. Really. Don’t believe the hype.

February 20, 2026 at 01:24

Jitendra Singh

I’ve been driving for 20 years and never had an accident. I dropped comprehensive last year after my 2011 Ford Fiesta got a cracked windshield from a stone. Paid £300 out of pocket. Didn’t even blink. Now I save £450 a year. I’m not rich, but I’m not stupid. If your car’s older than 2017 and you’re not financing, just keep liability. Simple. No drama. No stress.

February 20, 2026 at 10:38

Madhuri Pujari

Oh my GOD, you actually think people are dumb enough to believe this? "Full coverage"? That’s like saying "full body massage" when they only do your shoulders. And you’re seriously telling people to drop collision if their car is under £2,000? That’s like saying "don’t wear a seatbelt if your car’s older than 2008." You’re not helping - you’re enabling financial suicide. And telematics? Please. They use it to penalize you for braking too hard, not reward you for being safe. And don’t get me started on how they charge more if you live near a school. It’s a scam. A beautifully packaged, data-driven scam.

February 21, 2026 at 06:16

Agni Saucedo Medel

This was so helpful 😊 I just switched to liability-only on my 2017 Hyundai and saved £400! I’m keeping comprehensive though because I live in a city with crazy theft rates 🚗💨 Thanks for the clarity! 🙌

February 21, 2026 at 10:36

ANAND BHUSHAN

Ive had my 2014 Skoda since 2017. Paid £600 a year for full coverage. Dropped collision and comprehensive last year. Paid £250. Car still runs fine. No regrets. Just dont drive like a maniac.

February 22, 2026 at 23:23

Jen Deschambeault

Thank you for this. I’m new to the UK and was terrified about insurance costs. This made me feel empowered, not overwhelmed. I’m going to bundle with my home policy and get telematics. Small steps, big savings. 💪

February 23, 2026 at 21:50