Walking into the F&I office at the end of a car deal can feel like stepping into a courtroom without a lawyer. You’ve picked the car, negotiated the price, and now you’re handed a stack of papers thicker than a phone book. If you’ve ever signed something without reading it-then wondered later why your monthly payment jumped $150-you’re not alone. Most buyers don’t realize what’s in those finance documents until it’s too late. But understanding them doesn’t require a law degree. It just takes knowing what to look for.

What Is the F&I Office?

The F&I office stands for Finance and Insurance. It’s the final stop before you drive off the lot. While the salesperson got you excited about the car’s color and tech features, the F&I manager’s job is to close the deal financially. They’re the ones who explain your loan terms, offer extended warranties, and add on products like gap insurance or tire protection. They’re not there to trick you-but they’re also not there to help you save money. Their compensation often depends on what you sign up for, so it’s up to you to ask the right questions.

Key Finance Documents You’ll See

You’ll typically be handed five to seven documents. Here’s what each one means-and what you should check before signing.

- Retail Installment Sales Contract (RISC): This is your actual loan agreement. It states the total amount you’re borrowing, the interest rate, the monthly payment, and the length of the loan. Check the annual percentage rate (APR) carefully. It should match what the salesperson promised. If it’s higher than what you were approved for, ask why.

- Truth in Lending Disclosure (TIL): This federal form breaks down your loan costs in plain language. It shows the total finance charge, the total amount you’ll pay over the life of the loan, and the payment schedule. Compare this to your pre-approval letter. If the numbers don’t match, push back.

- Notice of Your Right to Cancel: This applies only if you’re buying a vehicle with a trade-in and the dealer is financing the difference. It gives you three days to cancel the contract if you change your mind. Most people don’t know this exists-so read it.

- Vehicle Purchase Agreement: This confirms the car’s VIN, price, and any optional equipment added. Make sure the mileage, model, and trim level are correct. A wrong VIN can invalidate your warranty.

- Service Contract or Extended Warranty: This is optional, but often pushed hard. Look for the deductible, coverage duration, and what’s excluded. Many warranties don’t cover basic things like wheel bearings or AC compressors. Ask for a copy to review later.

- Gap Insurance Agreement: If your car is totaled, gap insurance covers the difference between what you owe and what your insurance pays. It’s useful if you put little down or have a long loan term. But don’t buy it unless you need it. Dealers often mark it up by 300%.

- Insurance Declaration Page: This confirms your auto insurance meets state requirements. You must show proof of coverage before leaving. If you don’t have insurance yet, the dealer can sell you a policy-but shop around first. Dealership insurance is rarely the cheapest.

What to Watch Out For

There are common tricks-and honest mistakes-that can cost you hundreds or even thousands.

- Hidden fees: Look for charges like documentation fees, admin fees, or processing fees. In the UK, these are capped at £250 for new cars and £150 for used. In the US, they vary by state, but many dealers inflate them. Ask for a line-by-line breakdown.

- Rolling negative equity: If you owed money on your old car, and the dealer rolled that debt into your new loan, it’s easy to miss. That extra debt increases your monthly payment and total interest. Check the RISC for a line like “Trade-in deficit: $3,200.” If it’s there, you’re paying interest on money you already owed.

- Unnecessary add-ons: Tire and wheel protection, paint protection, fabric guard-these are rarely worth it. They’re sold because they’re profitable for the dealer, not because they’re useful to you. Most tires last longer than the warranty period, and paint scratches are covered by your regular insurance.

- Wrong loan term: A 72- or 84-month loan sounds good because the monthly payment is low. But you’ll pay way more in interest, and you’ll be upside-down on the loan for years. Stick to 60 months or less if you can.

How to Protect Yourself

You don’t have to sign anything on the spot. Take your time. Bring someone with you. Use these steps:

- Get pre-approved for a loan from your bank or credit union before you go to the dealership. This gives you a benchmark.

- Ask for all documents at least 30 minutes before signing. Read them in a quiet area. Don’t let anyone rush you.

- Use your phone to take photos of every page. If something changes later, you have proof.

- Ask: “Is this mandatory?” If they say yes, ask for the law or regulation that requires it. Most add-ons are optional by law.

- Verify the interest rate on the RISC matches your pre-approval. If it doesn’t, walk out.

- Never sign a blank form. If any field is left empty, refuse to sign.

What Happens After You Sign

Once you sign, the F&I office sends your documents to the lender. The lender reviews everything and may approve, deny, or request changes. If your loan is denied after you’ve already driven off the lot, you could be stuck with a car you can’t afford. That’s why you need to confirm the lender’s name and contact info. Call them within 48 hours to make sure everything’s in order.

Some buyers get a call saying, “We can’t approve your loan at the rate you agreed to.” That’s called a “yo-yo sale.” Don’t panic. You’re not legally bound until you sign the final contract. If they offer a worse deal, you can return the car and walk away. You’re not obligated to accept a new loan.

Common Myths About F&I Documents

- Myth: “The dealer will fix any mistakes.” Reality: Once you sign, it’s your responsibility to catch errors. Dealers won’t fix them unless you complain.

- Myth: “The F&I manager works for me.” Reality: They work for the dealership. Their bonus is tied to how many add-ons you buy.

- Myth: “I don’t need to read the paperwork because I trust the salesperson.” Reality: Trust doesn’t change the numbers. Always verify.

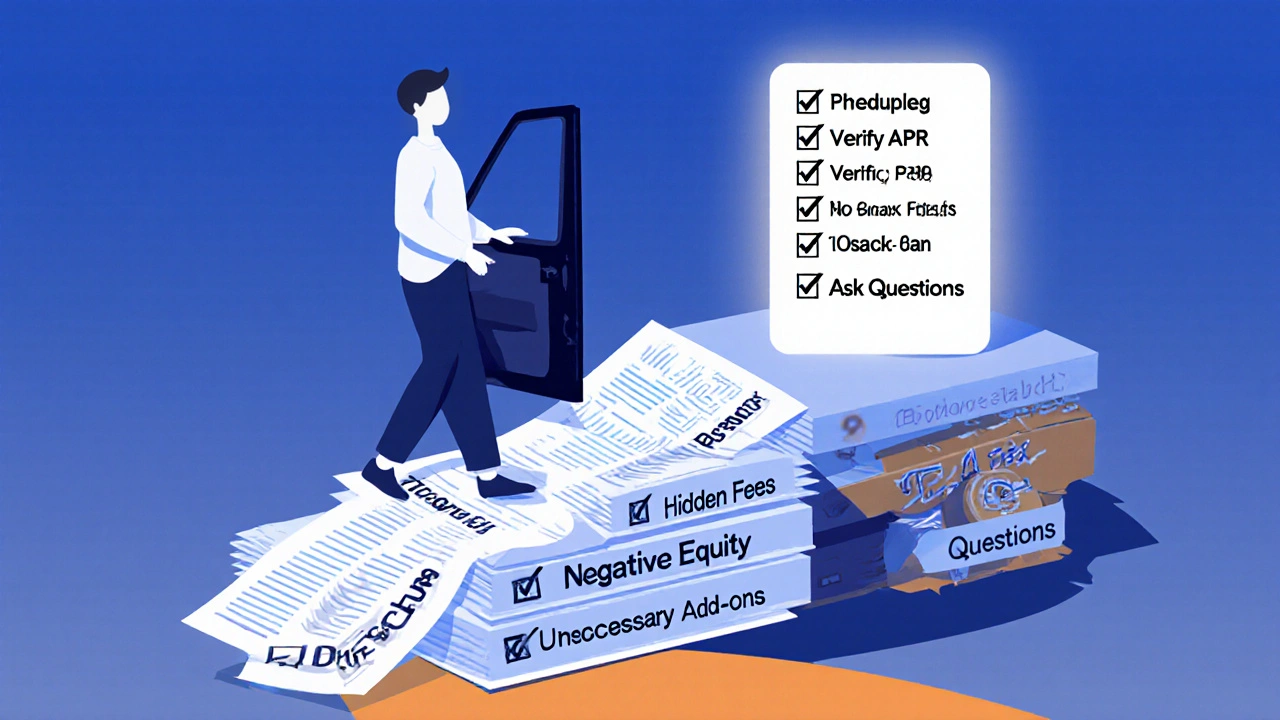

Final Checklist Before You Sign

Use this quick list to make sure nothing slips through:

- APR matches your pre-approval

- No hidden negative equity rolled in

- All optional products are clearly marked as optional

- Documentation fee is under £250 (UK) or legal limit in your state

- Vehicle details (VIN, mileage, trim) are correct

- Insurance coverage is active and meets legal requirements

- No blank fields on any document

- You have a copy of every signed document

Signing those papers is the last step-but it’s also the most important. The F&I office isn’t the enemy, but it’s not your friend either. You’re the only one who has your best interest at heart. Take control. Read everything. Ask questions. Walk away if something feels off. That car you’re excited about? It’s worth it only if you’re not signing away your financial peace of mind.

What’s the most important document in the F&I office?

The Retail Installment Sales Contract (RISC) is the most important. It’s your binding loan agreement. It shows your interest rate, monthly payment, total cost, and loan term. If anything else is wrong, you can still negotiate-but if the RISC has the wrong APR or term, you’re locked into a bad deal.

Can I refuse extended warranty or gap insurance?

Yes, absolutely. These are optional products. Dealers may pressure you by saying they’re “required,” but that’s false. You’re not required to buy them to get your loan approved. If they insist, ask to speak to the manager or say you’ll get it elsewhere. Most people don’t need them unless they’re financing for 7+ years or putting less than 20% down.

Why does my payment keep changing after I sign?

If your payment changes after signing, it’s likely because the lender didn’t approve your original terms. This is called a “yo-yo sale.” The dealer may call you back saying, “We found a better rate,” but it’s usually worse. You’re not obligated to accept the new deal. You can return the car and walk away. Always confirm your loan terms with the lender within 48 hours.

Are documentation fees negotiable?

In the UK, documentation fees are capped at £250 for new cars and £150 for used cars. In the US, limits vary by state. Even if there’s no cap, you can ask to reduce it. Many dealers will lower it if you push back, especially if you’re paying cash or trading in. Never accept the first number without asking.

What if I find an error after signing?

Contact the dealership immediately. If the error is in your favor (like a lower interest rate), they may not fix it. If it’s against you (higher payment, wrong VIN), they’re legally required to correct it. Keep copies of all documents. If they refuse, contact your state’s attorney general or consumer protection agency. In the UK, contact the Financial Ombudsman Service.

Comments

sumraa hussain

Bro I signed my car papers in 5 minutes once and ended up paying $400 extra for 'fabric guard' that literally just makes your seats look shiny for a week. Worst decision ever. Don't be me.

November 11, 2025 at 23:19

NIKHIL TRIPATHI

Man this is spot on. I didn't know about the RISC being the real contract until I got a call two days later saying my APR jumped from 4.9% to 7.2%. I walked back in with a printout of my bank approval and they changed it on the spot. Always check the RISC first. Always.

November 12, 2025 at 02:41

Rubina Jadhav

I just read this while waiting for my appointment. So helpful. I'm gonna take my time now.

November 13, 2025 at 03:58

Sandeepan Gupta

Don't forget to check the odometer reading on the Vehicle Purchase Agreement. One guy I know signed without noticing his 'new' car had 12,000 miles on it. Turned out to be a demo model they never told him about. Always verify VIN and mileage.

November 13, 2025 at 22:12

Rajashree Iyer

The F&I office is where capitalism sheds its skin and becomes a serpent. We walk in trusting, hopeful, believing in the American dream of mobility - and they hand us ink-stained contracts that turn freedom into debt servitude. The real question isn't what's in the papers - it's why we still believe the system will treat us fairly.

November 14, 2025 at 08:04

anoushka singh

Wait so you're saying I shouldn't trust the nice guy who smiled at me and offered me coffee? That's kinda rude lol. I mean he seemed nice.

November 16, 2025 at 00:53

Madhuri Pujari

Oh wow, so you're telling me the dealership doesn't actually care about me? Shocking. Next you'll say the moon landing was faked or that my phone is spying on me. I mean, come on - they're just trying to make a living too, right? Why are you so cynical?

November 17, 2025 at 18:08

pk Pk

Love this breakdown. I've trained over 50 young professionals at my company on how to handle F&I offices - and this is exactly what I teach. You're not buying a car, you're buying a financial product. Treat it like one. Take your time. Bring a friend. Record everything. You'll save thousands. And yes - you can say no to everything except insurance and the loan. Everything else is optional. You got this.

November 18, 2025 at 04:34

Jitendra Singh

Just had my first car deal last week. Took 45 minutes to read everything. F&I guy looked annoyed but I didn't care. Found a $1,200 'documentation fee' that was supposed to be $250. Asked for it to be cut. He did. Walked out with a handshake. No drama. Just clarity.

November 19, 2025 at 04:01

Nalini Venugopal

Small typo in the post - 'Tire and wheel protection, paint protection, fabric guard - these are rarely worth it.' Should be 'Tire and wheel protection, paint protection, fabric guard - these are rarely worth it.' You're missing the comma after 'paint protection'. Just saying, for the next revision.

November 19, 2025 at 09:36

Aryan Jain

They're all in on it. The F&I office, the bank, the government - they want you to sign without reading. That's why they make the documents 50 pages long. It's not about money - it's about control. They want you dependent. The warranty? A trap. The gap insurance? A scam. The loan? Designed to fail. You think you're driving a car - but really, you're driving a debt machine. Wake up.

November 20, 2025 at 04:29

Vishal Bharadwaj

Wait so you're telling me the 'documentation fee' isn't mandatory? LMAO. I'm from India and we have a 1000 rupee fee that's called 'processing' and no one questions it. You think Americans are special? Nah. You're just loud. Also, who reads a 50 page contract? Nobody. You're just paranoid.

November 21, 2025 at 14:08

Tarun nahata

This is the kind of knowledge that changes lives. You're not just buying a car - you're reclaiming your financial power. That stack of papers? It's not paperwork - it's your freedom contract. Read it like your future depends on it - because it does. Go in there like a CEO, not a customer. You're not asking for permission - you're setting terms. And if they don't like it? Walk. There's another dealership 3 miles away. Your peace of mind is worth more than any car.

November 22, 2025 at 02:40

Parth Haz

Thank you for this comprehensive guide. The emphasis on verifying the RISC and the Truth in Lending Disclosure is particularly critical. I would add that individuals should also request a copy of the lender's approval letter in writing before signing. This provides an additional layer of verification and protects against post-signing loan adjustments. A small, proactive step that prevents major headaches.

November 22, 2025 at 20:47

Shivani Vaidya

Reading this reminded me of my uncle who lost his car after signing without checking the trade-in deficit. He thought the dealer took care of everything. He didn't. He paid $18,000 more in interest over five years. Please - don't be like him. Take your time. Ask questions. Write things down. Financial literacy is not optional. It is survival.

November 24, 2025 at 19:39